- Federal Reserve interest rate decisions and monetary policy statements

- US non-farm payroll data and quarterly GDP reports

- Consumer price index and retail sales figures

The USD/MXN currency pair represents one of North America's most dynamic trading opportunities. Whether you're new to forex USDMXN trading or looking to expand your portfolio with Latin American markets, this comprehensive breakdown will equip you with essential knowledge to navigate this influential pair on Pocket Option.

What is USD/MXN?

USD/MXN represents the exchange rate between the United States Dollar (USD) and the Mexican Peso (MXN). This pairing directly reflects the economic relationship between the world’s largest economy and Latin America’s second-largest economy.

As one of the most actively traded emerging market currency pairs, USDMXN offers unique advantages for traders seeking diversification. Mexico’s strong economic ties with the United States–with over 80% of Mexican exports heading to the US–creates trading patterns influenced by both economies. For traders looking beyond major pairs like EUR/USD or GBP/USD, this instrument delivers exposure to Latin American markets while maintaining significant liquidity through USD participation.

How the USD/MXN Currency Quote Works

The USD/MXN quote follows a straightforward structure that’s essential to understand before trading. When USDMXN equals 17.50, it means 17.50 Mexican Pesos are required to purchase 1 US Dollar. In this relationship, the Mexican Peso serves as the quote currency.

Consider this practical example: When vacationing from the US to Cancún, Mexico, exchanging 100 US Dollars at a rate of 17.50 would provide you with 1,750 Pesos (100 × 17.50) for local purchases. Should the exchange rate shift to 18.00, your 100 US Dollars would yield 1,800 Pesos–an additional 50 Pesos of buying power as an American tourist.

Factors Influencing USD/MXN Movement

The USDMXN fx pair responds to several critical factors that successful traders monitor closely:

US Economic Indicators:

Mexican Economic Factors:

- Banco de México interest rate announcements

- Crude oil price fluctuations (Mexico exports approximately 1.2 million barrels daily)

- Manufacturing output, particularly in the automotive sector

- Tourism revenue statistics and remittance flows

Cross-Border Economic Relations:

- USMCA (formerly NAFTA) trade agreement developments

- Import/export volume changes between the countries

- Manufacturing investment shifts between the US and Mexico

For example, when the Federal Reserve announced a 25-basis-point rate hike in March 2023, the dollar strengthened against the peso, pushing the USDMXN rate from 18.10 to 18.35 within hours. Conversely, when Mexico reported stronger-than-expected GDP growth of 3.1% in Q2 2023, the peso gained strength, bringing the pair down from 17.90 to 17.65.

How to Read the USD/MXN Exchange Rate

Mastering USDMXN analysis requires understanding price movement implications:

When the rate climbs (e.g., from 17.50 to 18.00), the US Dollar is strengthening against the Mexican Peso. This typically occurs during periods of US economic strength, risk aversion in global markets, or Mexican economic/political uncertainty.

Conversely, when the quote falls (e.g., from 17.50 to 17.00), the Mexican Peso is gaining value against the US Dollar. This pattern emerges during periods of Mexican economic outperformance, rising oil prices, or US economic concerns.

For instance, if you observe the quote shifting from 17.62 to 17.82, this 0.20 increase represents dollar strengthening–potentially triggered by positive US manufacturing data or concerning inflation figures from Mexico.

Step-by-Step Tutorial to Quick Trading on USD/MXN

Here’s how to execute your first USD/MXN trade on Pocket Option:

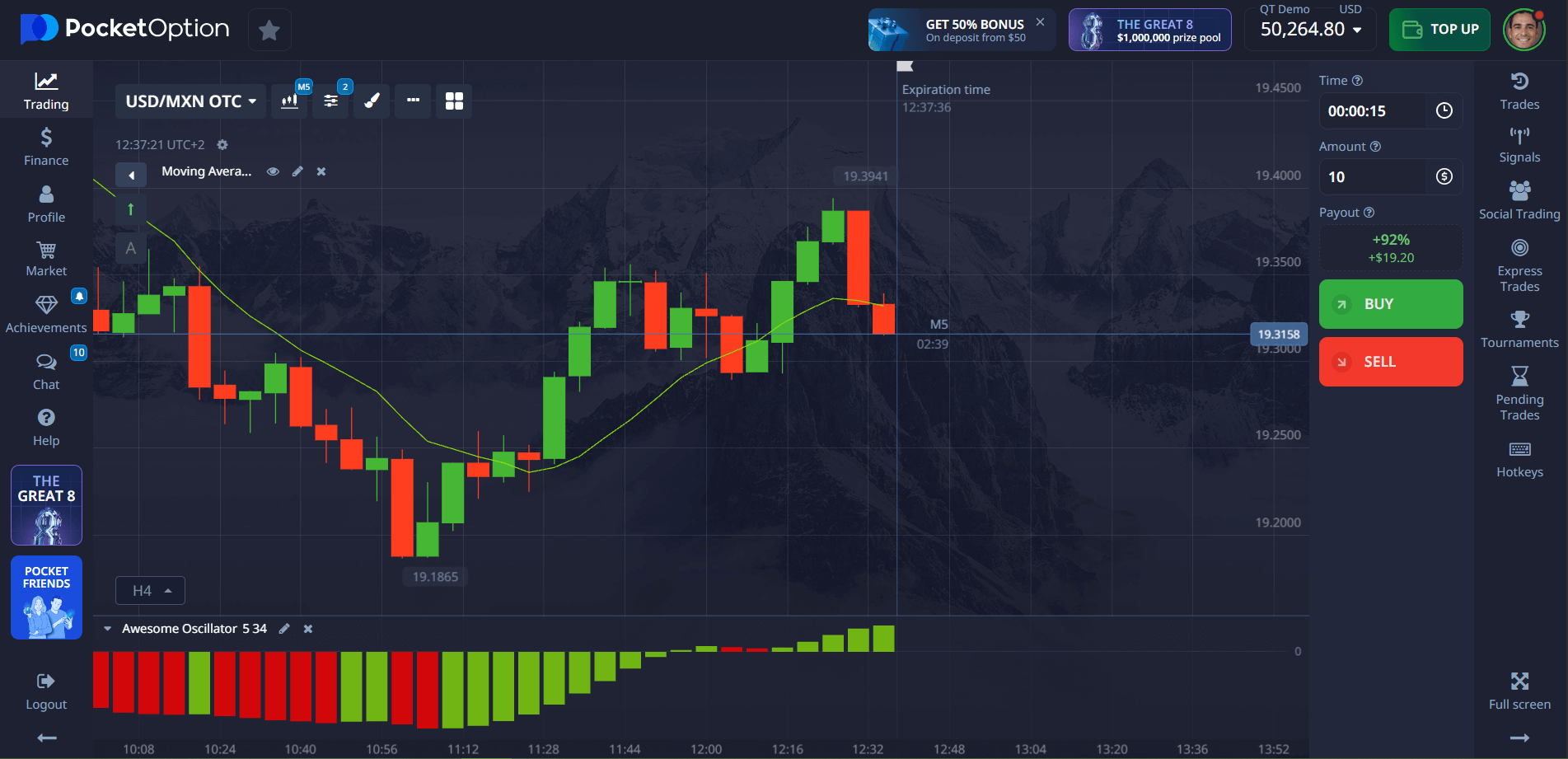

- Find the asset in the trading menu by typing “USD/MXN OTC” (available during extended hours when standard markets are closed)

- Analyze the price chart using technical indicators such as RSI, MACD, or moving averages. Alternatively, review the market sentiment analysis showing how other traders are positioned

- Select your investment amount (minimum $1, recommended 2-5% of your trading capital)

- Choose your trade duration (from 5 seconds and up for OTC assets)

- Make your price forecast: Select BUY if you anticipate the rate will rise, or SELL if you expect it to fall

- Confirm your position and monitor its progress

Each successful forecast offers returns up to 92%, with the exact percentage clearly displayed before execution.

Creating an account takes less than 2 minutes, and you can start trading with a minimal deposit of $5 (deposit may vary depending on payment methods) or practice risk-free with our comprehensive demo account.

Try Without Risk — $50,000 Demo Account Available

New to forex USDMXN trading? Wondering how to invest in USDMXN safely?

Upon registration, every new user receives a fully equipped $50,000 demo account. This risk-free environment lets you perfect your strategies, familiarize yourself with platform tools, and understand USD/MXN price action–all without risking your capital.

When ready to transition to live trading with a deposit from just $5, you’ll unlock premium features including:

- Copy-trading from verified profitable traders

- Cashback rewards on trading volume

- Weekly trading tournaments with substantial prize pools

- Advanced charting capabilities and technical indicators

- Educational webinars and market analysis

FAQ

What is the best time to trade USD/MXN?

The optimal trading window is during the North American session overlap, specifically between 8:30 AM and 4:00 PM Eastern Time when both US and Mexican markets are active and liquidity peaks.

How volatile is the USD/MXN pair compared to major forex pairs?

USDMXN typically exhibits moderate to high volatility with average daily movements of 80-120 pips, offering more price action than EUR/USD but requiring appropriate risk management.

What is the sentiment of USDMXN stock?

While USDMXN is a currency pair rather than a stock, its market sentiment typically correlates with risk appetite, US Dollar Index trends, and Mexico's economic outlook relative to other emerging markets.

How to invest in USDMXN as a beginner?

Start with Pocket Option's demo account, learn to interpret economic calendars focusing on US and Mexican data releases, and master basic support/resistance analysis before trading with real funds.

How to buy USDMXN on Pocket Option?

Simply register an account, make a deposit, select USD/MXN from the asset menu, and place a BUY order if your forecast anticipates dollar strengthening against the peso.